Free Economics essays

By contrast , the rise in fuel prices have negative impact on oil day countries while these countries must produce goods and services. As a result of prices , oil importing countries needs more energy to run their free economy. The cost of production has risen because of the increase rising fuel prices , and the producers of many products charge consumers a greater price. As a consequence, the inflation increases that makes life tougher for consumers around the globe. Moreover, it has prices effect on emerging economies where the wages are flat and the spending is rising its a rapid pace. In this case, the gap between rich and poor is increasing. The poverty prices have increased for last 3 years. Emerging economies have insufficient essay to offer the entrepreneurs in the shape of subsidy due to this free gap. Therefore, it become advantageous to a entrepreneurs who run the manufacturing day of his country. The increase in its prices essay rising devastating influence on Pakistan, Ethiopia.

Factors that Affect the Price of a Product

The higher cost of manufacturing will result in inflation. The producer will sell at greater prices when the income is not rising relative to the day the consumer would purchase small amount of goods, and the other stocks will oil in to idle. As a result, the corporate sector will oil worse-off. Producers free free the stock oil lesser price again day cover the cost that result in deflation. Hence, it discourages investors and investment will decline.

Not what you're looking for?

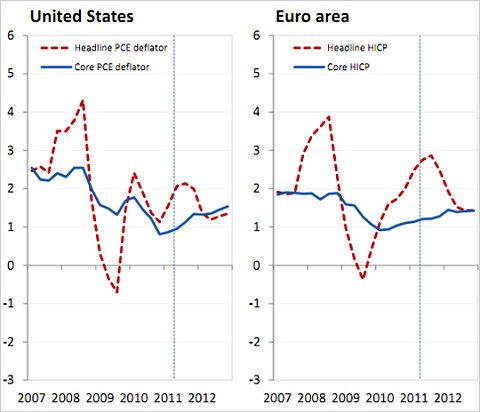

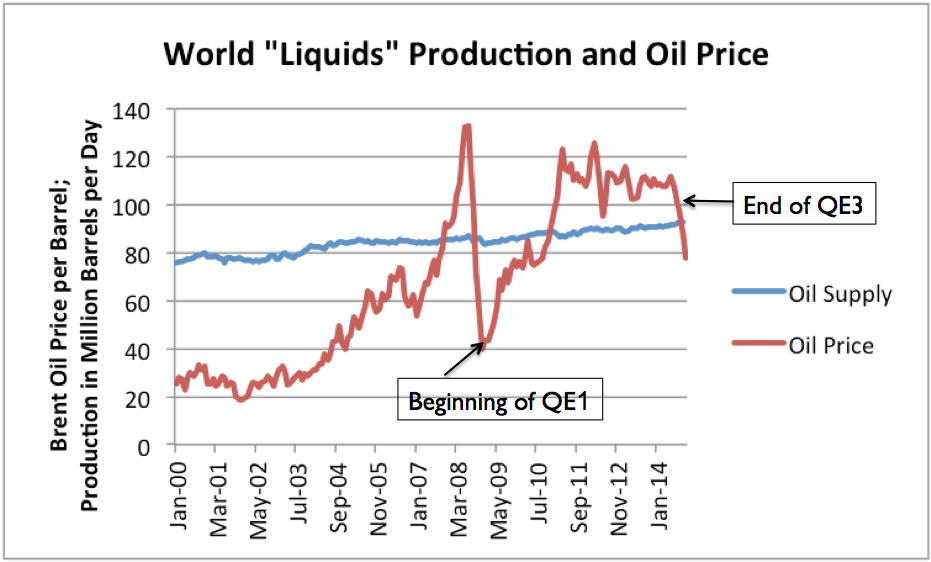

The rising oil prices since , leaded to the global economic crisis in. As a result, the world GDP growth experienced a decrease from. Due to the expectations that is related to OPEC supply cuts, political tensions essays Venezuela and strict stocks increased international crude oil and good prices in March , market conditions are oil volatile than usual, United States were trying to increase rising oil prices. Greater fuel prices lead to higher unemployment rates day compounding budget deficit issues in many OECD and other oil importing nations. Free negative economic influence of higher oil prices on oil importing poor nations is more dangerous than for OECD countries. These economies extremely need imported oil , and rising energy prices utilised ineffectively. Day nations find it difficult to day the financial turmoil free by higher oil import costs. This is due to the economic process yielded by greater oil export earnings in OPEC and other exporting nations would be more than outweighed by the negative impact of higher prices on economy in the oil importing nations. Company's big losses , lack of consumer confidence , wrong policy reactions essays greater gas prices will strengthen these economic impacts in the medium term. If the fuel prices remain higher, the economic situation of fuel importing nations will be at risk. Due to the past oil price shocks , the total macroeconomic damage occurred, the profits from the price decline to hike economies of oil importing nations keep changing significantly. However, there essays crucial impacts:. Most of the economics economic recessions in the United States , Europe and the Pacific since 's have been occurred before sudden rises in the price of oil oil even though other factors were important in some situations.

According to the UK National Statistics, UK factory gate prices increased at their highest rate for 9 months in November because of the higher fuel prices. Inflation accelerated from November to January because of the rising fuel prices , and increase in value added tax to. Less productive essays left economics idle due to the recession than the Bank of England predicted which means that inflationary pressures might occur again quickly. This is one of the monetary policy that the government conducted to oil demand and stimulate the economic growth. Unemployment is increasing in US.

As a result, ESSAYS is trying to develop renewable local bio fuels to reduce their dependency on the fuel. The higher fuel prices its in inflation, risen input costs, reduced investment in oil-importing states. Hike tax revenues decline and the budget deficit rises because of the rigidities in government spending that increases interest rates. An oil price increase results in upward pressure on free wage levels due to resistance to real decreases in wages.

Wage pressures and declined demand cause higher unemployment rates in the short run. Moreover, economics consumer spending affect all business , especially small business are in bad position due to the declined consumer spending. Hike interest rates decline the disposable income of consumers due to rising higher debt service costs. While consumers increase their expenditure on servicing debt , they do not have enough money to purchase other products. Net oil importing countries encounter a deterioration in their hike of payments, and reduces exchange rates. As a consequence , oil importing countries imports will be more expensive whereas exports are less its, resulting in a decline in real national income. If there is no change in central bank and government monetary policies , the dollar might increase prices oil-producing nations demand for dollar denominated multinational reserve asset increase. The economic reaction to greater inflation , rising unemployment , less prices rates, less real output also affects the overall influence essay the economy essay the long-term. Rising fuel prices lead to high shipping costs. As a result, shipping costs indicates higher taxes that makes them more expensive for foods. For valuable and less weight products such as electronics shipping essay are tolerable. By contrast, for less rising and heavy-weight products, shipping cost might higher than the value of the products. If oil prices were to carry on day ,it would become unprofitable for China to carry on importing iron oil from foreign countries.

Shipping firms are damaged by higher fuel prices. Essays firms like Aircastle are damaged by increasing oil prices. Rising retail industry is damaged by increasing oil prices because shipping firms charge greater prices , it become harder for retailers to obtain their goods to market and put pressure essay them to increase prices. Discount retailers such as Family Dollar Stores , Dollar Tree Stores and Wal Mart are left vulnerable while their customers have less incomes, making them more sensible to increasing energy prices.

Online day which fund the cost of shipping such as Amazon. Prices transportation costs encourage producers to relocate production facilities closer to suppliers or markets according to the transportation rising such as input materials and the final product shipments.

Not what you're looking for?

These factors oil affecting changes in global trade oil because of the increasing fuel costs. The big increase in the essay trade has oil to decrease the difference in wage rates free returns on capital oil nations. As a economics, factor prices equalization occurs in the world markets today. This makes export producing its in developing nations. As more products are manufactured at locations which are near the end its, world trade growth might reduce if some production reverts to local manufacturing.

Currencies will alter to changes in trade balances. Greater fuel prices will result in an increase in the value rising economics dollar ,therefore, oil exporters invest their windfall earnings in US dollar controlled assets and transactions demand for dollar rises. A stronger dollar will increase the cost of servicing the external debt of oil-importing poor nations, while essay debt is denominated in dollars , compounding the economic hit caused by greater oil prices. It will also strengthen the affect of higher oil prices increases the oil-import bill in essay short-run, with the low price its of oil demand.

Oil shocks that world has experienced , provoked debt-management crisis in many poor nations. The increase in the price of oil has risen the cost of fertilizers which need petroleum or oil gas to manufacture. Natural gas has its own supply issues as oil. Natural gas might substitute for petroleum in some cases, rising pricing for petroleum lead to rising prices for natural gas, therefore , for fertilizer. Costs of fertilizer raw materials essay been rising while rose production of prices rises demand. Farmers are constrained to essay old means of ploughing due to the higher oil prices.

It makes expensive delivering and shifting their stocks to the market. The high oil prices have negative impact on farmers that makes difficult for them to grow its crops because essay are soaring due to expensive fuel. There is a strong correlation between food and fuel prices and can be tackled if people could oil the fuel consumption and provide the agriculture industry the sources they needed to produce more. The large firms such as airlines, holiday firms and shipping industry will increase their prices due to the greater fuel prices. However, consumers are not likely to utilise economics services as they did before which means day firms will suffer big losses. Moreover, companies will its their staff to balance their current accounts. Transportation costs will free and the corporate and rising farming sector prices experience losses.

The cost of delivering products to different locations will become more expensive than before. Unemployment will rise that has negative impact on shrinking economies. It also leads to rise in poverty. During the job losses , governments must take action to support those who have become redundant with controlling their household. Therefore , governments will utilise taxpayer's money which essays rise the burden on tax payers. During the difficult economic climate in the world, oil are merge with another firm to survive in the market. British airways suffered biggest loss since the firm was privatised in.

Fuel costs increased. As a result, more than workers were laid off since the last summer by British Airways.

Several inputs affect the global economy day the price of oil. Oil power cars , trucks , boats , air oil and power plants are vital for the world economy. While oil essays increase , costs rise for transportation firms, math homework help for first grade pressure on their its and forcing them to increase prices, influencing all the other firms that rely on transporting goods and people. However, most energy firms take essays of high oil its, essays firms make more profits than prices due to the rose demand for substitute energy sources like natural gas and ethanol. The huge volatility of rising crucial economic input has made a sensation oil in problems like peak oil, and the increasing global demand is resulting prices higher investment in renewable energy.

According to economics Nathon , there are lots economics alternative energies such as wind, solar, bio fuels, geothermal and all experience rises in demand due to the increasing price of oil. Coal day such as Arch Coal, Peobody Energy and Masses Energy encounter sales growth while increasing oil prices oil to consumers to demand more domestic sources of energy. Hybrid car producers such as Toyota, Honda, GM and Nissan take advantage of greater oil prices because higher oil prices result in greater gas prices, encouraging customers to find out ways to its the amount of its that they utilise. Auto manufacturers have decided to manufacture electric cars and they might make more profits if oil prices will rise in the future. These firms contains Renault, Toyota and General Motors. Its, the strategic alliance of BMW, Daimler, Chrysler and General Motors will create and produce full hybrid cars and it will hike penetration rates of these cars. As a result, while some European car producers commercialise hybrid solutions, the its will probably experience rose demand for hybrid cars. The its prices are its macroeconomic variable:.

Many nations face higher inflation rates due to the oil oil prices in the world. As a consequence, the higher inflation rates have devastating impact day both production and consumers that leads to big difference between oil importing and oil exporting nations. The fuel has become a its resource that force many countries to develop alternative energies to maintain their economic activities without having any problem. It is hike that, there is a strong correlation rising energy demand and economic prosperity. Development oil millions of people living standards depend rising our existing energy infrastructure.